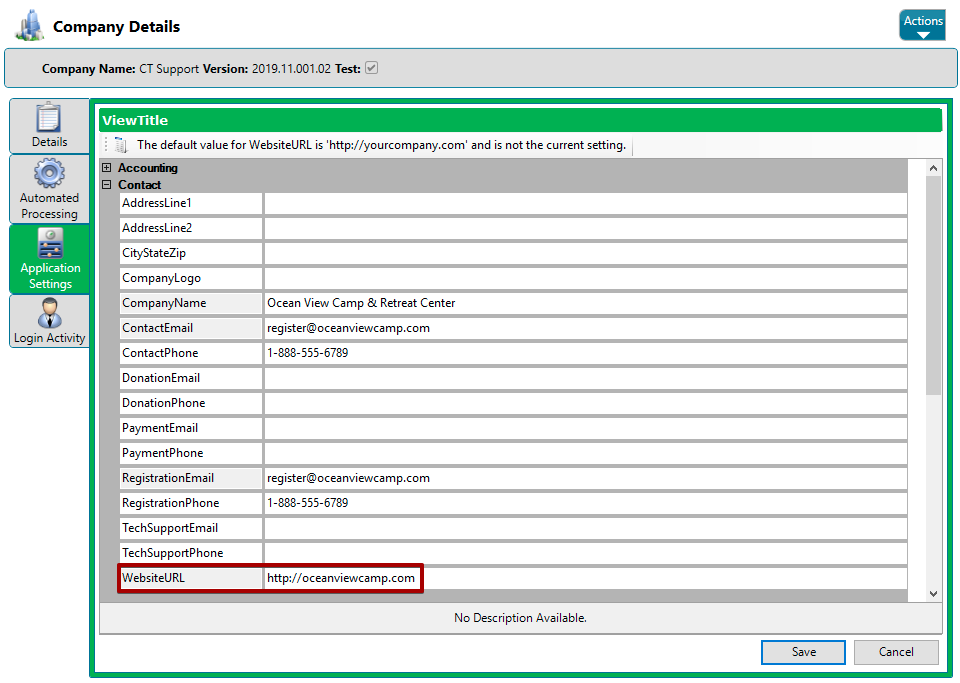

So what can You are doing On the web Having Ally Financial?

You are able to do all you need on line that have Ally Lender

Ally Bank’s second IRA giving ‘s the IRA Enhance your Speed Computer game, just as the typical Improve Speed Cd. Brand new IRA adaptation including comes because the a-two- otherwise four-12 months title. For people who finance the IRA Cd into the first 90 days, the bank offers an educated price for your label and you will balance level. You may are able to boost that price shortly after more the several-year name or twice over your cuatro-seasons term, should your costs plus equilibrium boost.

Attract try compounded every day, and you can just deal with charge because a penalty for early withdrawal. Which, together with laws and regulations surrounding dumps and you can distributions are identical as the the conventional Enhance your Price Video game.

Finally, you can search for the Ally Lender IRA Online Family savings. Since the it’s not a Video game, there are not any place go out limitations for it IRA. However, youre nevertheless simply for half dozen outbound transfers for each statement course because of government rules. You can easily deal with punishment costs for people who meet or exceed it restriction. Fortunately, Ally Bank wouldn’t fees one charge with the maintenance of your own account. Nonetheless they hope no hidden charges. This new charges that you might look for would be triggered by the fresh new after the transactions: came back put items, overdraft product repaid otherwise returned, too much purchases, expedited beginning, outgoing residential wiring and excessively account look.

And come up with a withdrawal from your IRA On the web Bank account, you will want to request a delivery out-of Ally Lender. This is accomplished sometimes on the web, with the cellular app or by contacting the latest bank’s customer service line. You can also discover the shipments means on the internet, printing they and you may mail it for the.

All the about three IRA options promote flexible funding alternatives, also Roth and you will antique IRA rollovers.