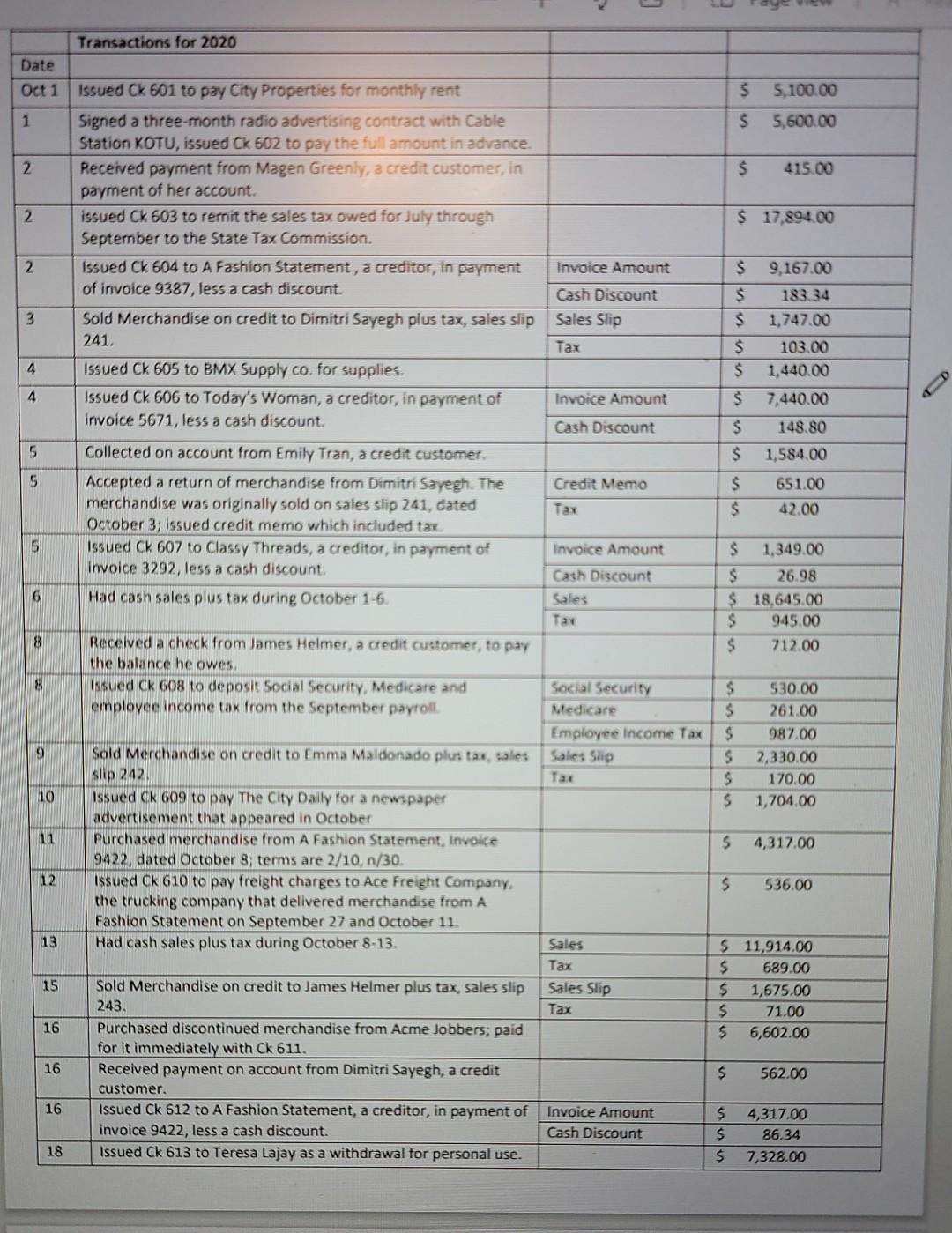

100% Financial support Mortgage brokers into the New york & Pennsylvania

100% financing financial into the Ny & Pennsylvania seems to be an interest that comes up much. A couple of times whenever i in the morning away attending personal occurrences, this new discussion transforms on financial industry and all sorts of americash loans Daphne new 50 % of recommendations that public has actually read from media.

Some body always appear for me and you may remark about every high-risk mortgage loans which were over and the things about the sub-primary meltdown for the Ny & Pennsylvania. I usually pay attention to I can’t believe these were creating 100% funding home loans!

To find out more phone call (833) 844-0141 now, request a totally free Mortgage Offer or prequalify to discover more regarding offered mortgage solutions.

100% Financing Home loan for the Ny & Pennsylvania: Mortgage loans That need Absolutely nothing Money Down

Nowadays, 100% resource financial when you look at the New york & Pennsylvania isnt a very high-risk financing to your lenders.This new money which were over over the past couple of years in the 100% money mortgages was indeed risky because they was in addition to No Money confirmed. The combination ones dos items are what made those individuals financing therefore high-risk. A mortgage is as a great as the feature of your debtor so you can re-spend the money for financing. All fund that went crappy, was in fact the result of extremely speculative buyers who have been getting into belongings with no money off, with the expectation out-of flipping all of them for an income. In the event that business became, these types of borrowers was indeed remaining carrying the fresh hot potato and just fell them. They couldn’t manage to result in the costs and you will let the property head to property foreclosure.

100% Financing Home loans from inside the New york & Pennsylvania

Now, 75% of all the my new buyers are making down repayments ranging from 0-3% down.