Allow your house’s well worth work for you

Your home is another element of your loved ones, even though it cannot do the garbage aside or clean the fresh new restroom, you need its collateral to include your monetary liberty and you will freedom.

From your home improve tactics in order to debt consolidation reduction in order to tuition repayments, Verity’s several household equity mortgage items offer you new tips to help you create all you have to manage if you wish to carry out it. Our friendly credit pros can help you find the primary solution for your unique problem. Whether which is a great Masterline house guarantee credit line otherwise a great lump-sum fixed label mortgage, we have been right here for you.

Masterline Domestic Collateral Line of credit (HELOC)

Place your money in which it issues most having a property guarantee line of credit. All of our Masterline HELOC features repaired speed choice, providing the flexibility so you’re able to protected a portion of their harmony at the a predetermined rates.* Safety virtually every style of repeating cost, away from scientific costs to college university fees, and shell out desire merely on what you may spend. Save money and you will big date by cutting out records-implement shortly after and you can access your entire borrowing limit as much as ten decades!

Fixed Domestic Equity Financing

Ready to put an inclusion on your family, or upgrade your kitchen or restroom? A fixed speed house collateral financing provides a swelling-sum up side then hair your set for a certain term and price so you know exactly what your monthly responsibility try before you even initiate your panels. No annual charges and no surprise improvement in money, this might be a choice for individuals who understand what it you desire and should do something.

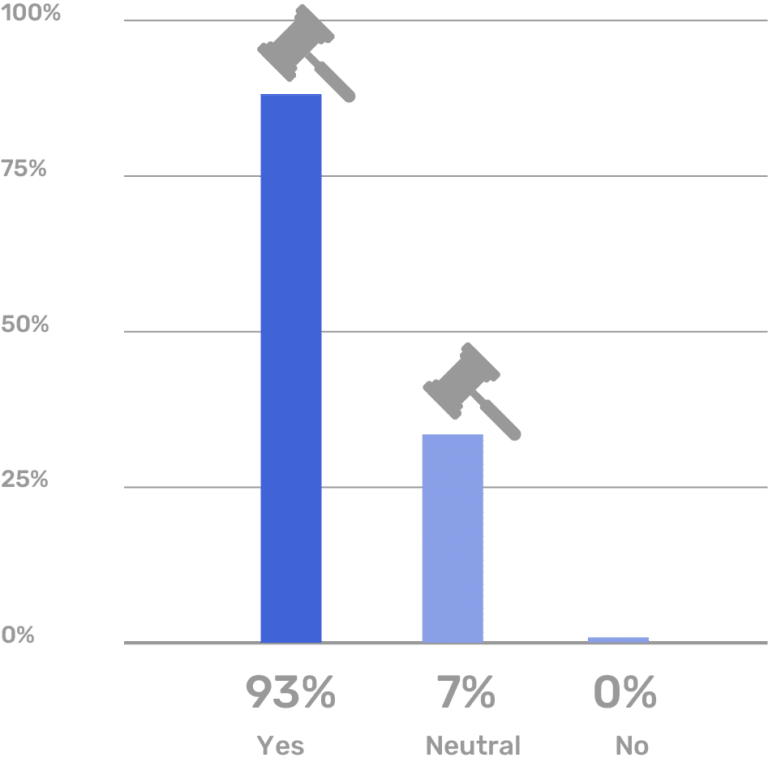

You have got an alternative during the the place you financial

Verity was a local borrowing from the bank union one to thinks for the socially in charge banking.