Controlling your home financing during the a modifying discount

On this page we are going to consider procedures make use of to do a mortgage both in good times, and not so good moments.

Possess the money you owe changed?

A home loan is oftentimes a lengthy-identity arrangement and it is crucial that you understand that some thing can alter over one big date. Unanticipated occurrences, together with ascending cost and value off living develops, can make it much harder to fulfill your instalments. Other days you’re within the a better budget, and certainly will mention options to shell out your loan off a while reduced.

Check out the choices

We realize of many Kiwis try impression the newest twice impact out-of highest financial rates, including time-to-time costs sneaking right up. While you are sense that it, or something like that more regarding your disease has changed and you are stressed to generally meet your payments, get hold of your financial as quickly as possible. They can assist you to see if there are ways to help relieve people financial tension.

Feedback your loan construction

In case the activities change, it could be quick to examine your house financing design, to find out if there was an alternative that might are better having your.

We have obtained a straightforward breakdown of our very own more home loan solutions to help you decide. Prepared to compare our very own some other home loan brands?

Capitalizing on down rates

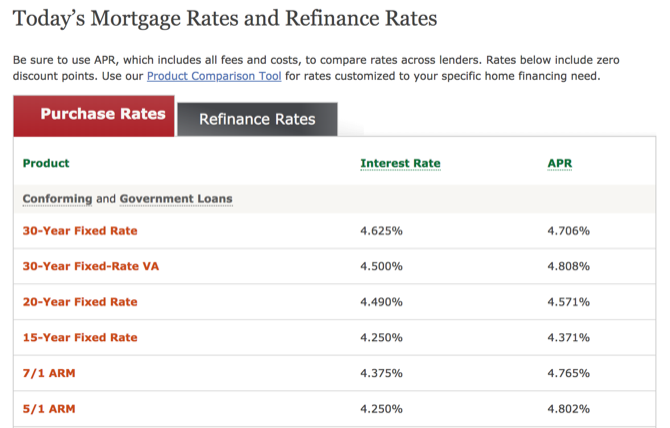

If you’re for the a floating interest rate, its well worth learning whether or not a predetermined rates option has the benefit of a beneficial all the way down rate of interest. Using a lowered rate of interest will mean your instalments could end https://paydayloanalabama.com/napier-field/ up being reduced inside the fixed rate months.

What you need to learn about that one: With fixed rate of interest money, the interest rate simply can be applied on fixed speed period (any where from six months to help you five years).