Do you wish to Go on to a different Place?

The fresh discount is still experiencing the consequences out-of COVID and you will earnings is at exposure. It is possible to ask yourself when it is foolhardy to purchase another assets when you find yourself already strapped for cash.

Naturally, a lot of people want to get returning to the market. Yet, if your earnings drops once again otherwise prices begin to slip, this is high-risk for your family and you can enough time-label financial balance.

If you prefer more income in the short term it could be much better never to chance a lot more loans into the other household buy until things balance economically.

Exactly what are My personal Greatest Options?

You really need to have a look at what you are trying to reach. And you will envision in your disease whether it’s far better use extra cash, otherwise buy and sell.

If you have equity of your house and are generally given purchasing several other family, it may be practical to market and get the fresh household. This may allows you to generate more substantial buy with no several payday loan Heeney mortgages at a time. A lot of people select attempting to sell their property to get a much convenient processes than just going through the application for the loan and you may recognition process.

One thing to think is that you must keep your household for the next use, such as renting it out or using it as the guarantee into upcoming fund.

It’s important not only to look at if preserving your domestic will save profit this option including and also how one to choice make a difference to anything down the road.

It indicates having plans ahead of borrowing off guarantee. Make certain you might be alert to the advantages and disadvantages thus you may make an educated choice on which is perfect for you!

Are you ready so you’re able to Retire otherwise Downsize Your home?

This can feel the advantage of reducing most of the home loans, having an alternate house, and money throughout the financial. This is exactly simpler and you may be concerned-100 % free compared to the delivering most personal debt and you may depending on tenants so you can care for your house and expenses lease timely.

Do you want to Add accommodations Possessions into the Collection?

If you are considering incorporating a rental property toward collection, this may be helps make a great deal more sense and get advantageous to you to make use of the latest security of your property. it has some professionals inside the taking on the fresh financial obligation out-of some other bank.

The advantage of this can be one as opposed to paying the rent with money appearing out of pocket monthly, someone else will pay the loan – so you will find a full time income weight currently created without having any work required on your part!

But remember, to buy an investment property try a business and also in any organization, there can be some risk you should be more comfortable with.

You’ve noticed the choices while nevertheless can not decide what to create? That’s ok! The main merely to consider.

What will You select?

If you feel now that home prices will stay going up, upcoming bringing some other household can be sensible however, if out-of upcoming speed increases. Do i need to use a house collateral loan buying another household?

If you intend into the becoming your local area, it might not become beneficial to have a security loan as the prices you’ll alter otherwise property opinions fall off over time.

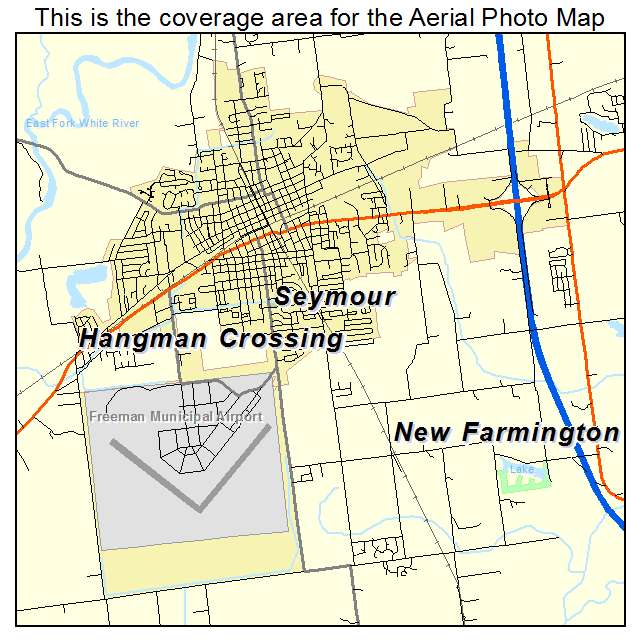

For many of us offering their residence, to acquire another house is the most suitable choice. But rather than waiting to find customers, you have access to our very own website to rating a finances offer for the your property today.

You need to into consideration the cost of one another mortgages and should your earnings is secure the additional home loan repayments. It is important that these data will work for your because the better as your family. Having an authentic concept of how much cash your instalments would be is very important to work through value. It is important not to ever overextend oneself financially.