An out in-Breadth Look at Huntington Lender Signature loans when you look at the

The newest rating of the Finanso relies upon our editorial class. The latest rating formula is sold with an economic tool method of along with tariffs, charge, advantages and other selection.

The fresh score by the Finanso is dependent on the article group. The newest scoring formula boasts an economic product sorts of including tariffs, charge, perks or other alternatives.

This new get from the Finanso depends on all of our article party. The newest rating algorithm includes a financial equipment form of in addition to tariffs, charges, rewards or other selection.

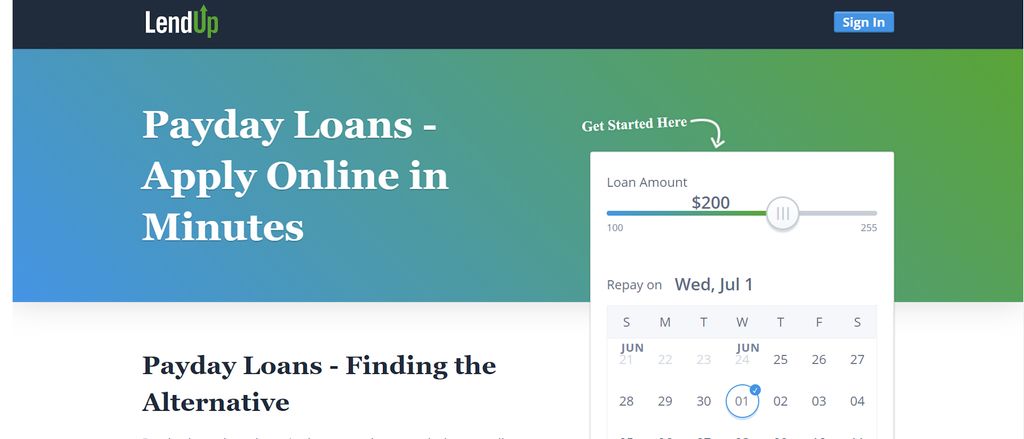

Fool around with our online calculator to track down wisdom towards the you’ll mortgage wide variety, interest levels, and payment dates. It’s a vital device for your credit needs.

In america, personal loans was courtroom and you will generally employed for non-company needs. They have to be paid off depending on the financing agreement, with attention and you may a repayment schedule. Some laws manage these types of money, including the Equal Credit Chance Operate , the new Fair Business collection agencies Strategies Operate , additionally the Specifics when you look at the Financing . This type of laws and regulations include both lender’s interests and borrower’s legal rights, guaranteeing fairness and you can transparency from the financing process.

What are Huntington Bank loans?

Whether you are believe a house lso are relationship, otherwise you prefer financial assistance for a serious bills, individualized money regarding Huntington Lender is also fit your needs. When you are strained with a high-appeal debt, a personal loan could also be used having debt consolidating. Find out more about its choices and you will conveniently implement on the web or even in people.

Has

- Competitive Unsecured loan Prices. Huntington brings aggressive consumer loan pricing, ensuring certified consumers receive beneficial interest rates that are nevertheless repaired through the the borrowed funds label. New unsecured personal loan interest diversity was 8.97%-% Annual percentage rate. Put secured unsecured loan rate of interest assortment is actually 8.26%-% Apr.

- Flexible Payment Choices. For added comfort, borrowers feel the independency to find the big date of the very first fee, enabling a windows all the way to two months immediately following closure the mortgage.

- Flexible Terms. To advance match private financial things, Huntington facilitate people in choosing a loan term you to aligns with its budgetary means, bringing in check money.

- On the web Membership Management. Which have online account management, people can save hard work. Capable effortlessly check its financing harmony, song transaction record, and conveniently make repayments from the electronic program because of the opening their personal bank loan account on line. Which streamlined procedure advances benefits and you will show to have consumers.

Huntington Bank Personal bank loan Alternatives

From the Huntington, customers get access to several unsecured loan selection. The brand new unsecured personal bank loan choice lets individuals to obtain that loan according to their credit file, since the covered personal loan option is partially according to the worth of private possessions. Which liberty enables borrowers to find the mortgage variety of that aligns best the help of its monetary standards.

Unsecured Unsecured loans

For those seeking an enthusiastic unsecured personal loan, it same day installment loan New Mexico can be used for several motives particularly family repairs, medical expenditures, debt consolidating, and. Moreover, going for it loan type can potentially get rid of monthly payments and you will spend less over the loan’s stage. Qualifications for this financing relies on factors instance borrowing get, debt-to-money proportion, and other financial factors. Depending on qualifying points, consumers can access to $fifty,000 with a fixed interest rate and versatile percentage solutions.

Secured personal loans

The new deposit-covered consumer loan option offers the advantageous asset of all the way down interest rates as it’s supported by equity. That it financing allows individuals money personal expenditures, make the most of smaller rates of interest, manage their deals requires, and you will on top of that build the borrowing courtesy consolidated monthly installments. Huntington accepts collateral because a good Huntington Certificate out-of Deposit (CD), Huntington Family savings, or Huntington Currency Sector Account. On the put-secure mortgage, borrowers could easily obtain around the value of its put, in fact it is of up to $five hundred,000, while you are enjoying the capability of consolidated monthly installments.