Basic, Virtual assistant financing enable it to be reduce repayments than other regulators home loan apps

Active-obligations services participants features substantially lower homeownership costs compared to general people. These lower prices is actually largely explained by class off the current active-duty provider people-he is https://www.cashadvancecompass.com/loans/bad-credit-line-of-credit/ more youthful, was diverse, and you can circulate seem to-however, enhancing the You Service off Experts Facts (VA) mortgage program could help a whole lot more services participants and you can veterans purchase home.

Inside the detection of National Armed forces Appreciation Times, we talk about advantages and you may downsides of Virtual assistant mortgage system in today’s highest-interest-rate ecosystem. Regardless if Va loans could possibly offer lower down payments and you can financial interest prices than other apps, sellers is generally less inclined to take on even offers from buyers using on the program.

Despite current program improvements, the Virtual assistant and you may federal policymakers you are going to create so much more to make sure the Va mortgage program assists anyone who has supported the nation pick homes, generate wide range, and sustain their homes in times away from pecuniary hardship.

Benefits associated with this new Virtual assistant financial program

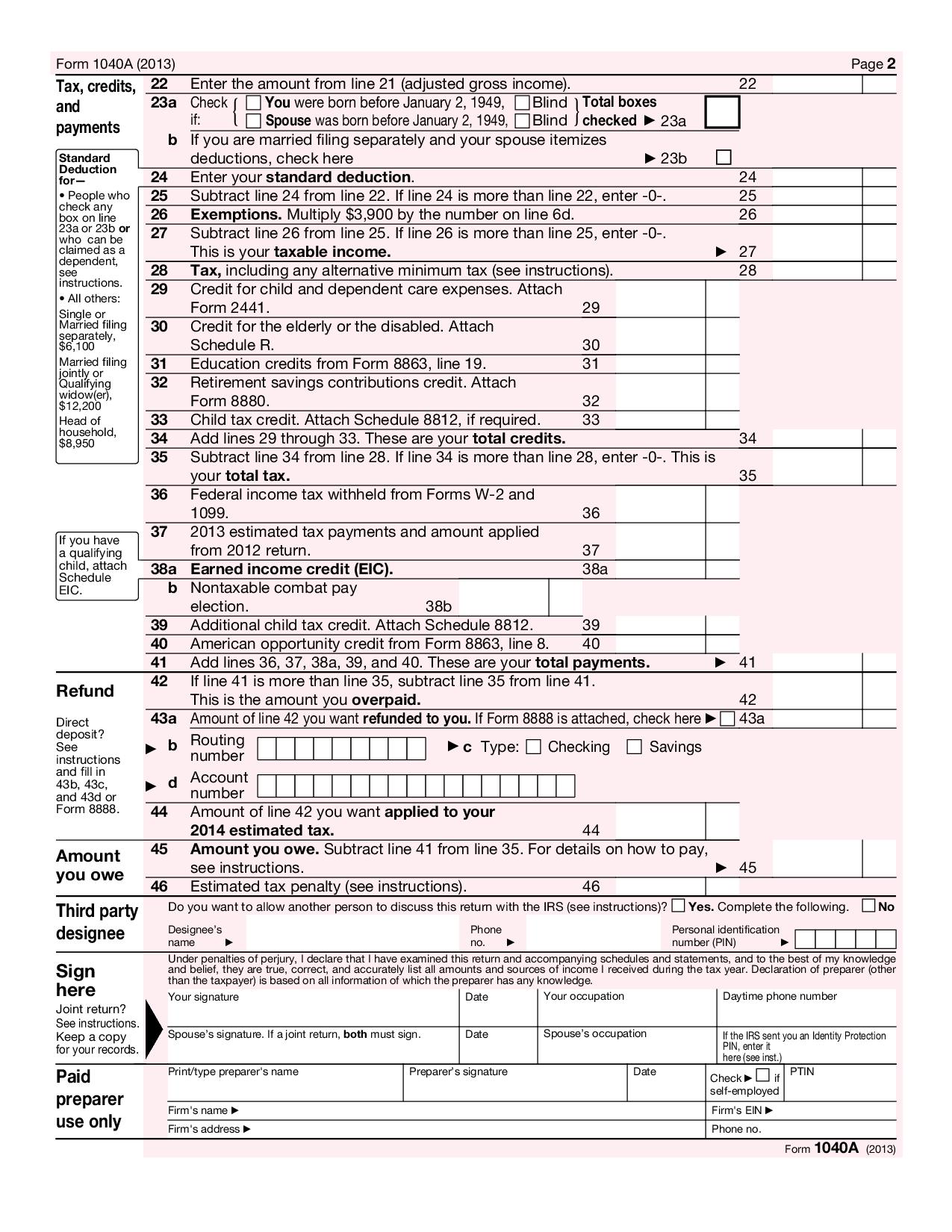

Virtual assistant mortgages essentially need no down-payment. Compared, Government Houses Government (FHA) mortgages want step three.5 % off, and you can bodies-paid enterprise (GSE) fund wanted 3 per cent to possess individuals that have down revenue otherwise 5 percent to own borrowers that do maybe not be considered due to the fact lower income. Centered on 2022 Home loan Disclosure Work (HMDA) research, 73 % out-of Virtual assistant consumers set 0 per cent down when purchasing a home.

Virtual assistant mortgage loans basically cost less than other mortgage loans. Considering 2022 HMDA studies (2023 investigation commonly totally readily available), the new median interest towards Va financing are 4.75 %, compared with 4.99 per cent toward antique loans and you can 5.13 % to your FHA finance.

Va money plus encountered the tiniest express regarding loans having interest costs significantly more than eight % as well as the premier display out of financing which have prices less than step 3 per cent. The genuine advantage of Virtual assistant funds could be huge, because prices dont echo the fact specific consumers which have GSE mortgage loans must have individual financial insurance policies. Rates toward FHA loans also do not include the program’s annual 0.55 percent mortgage cost.

Fundamentally, Va finance have straight down assertion cost, regardless of the borrower’s race or ethnicity. Over the years omitted from homeownership or any other wealth-strengthening ventures, families of colour still have straight down homeownership pricing than just light family. However the racial homeownership gap is actually quicker certainly one of pros and you can service professionals than in this new nonmilitary people. Denial pricing are rather lower among Black colored and you will Latine Virtual assistant home mortgage individuals compared with Black colored and Latine borrowers applying for most other kind of funds.

Cons of the Virtual assistant financial system

Basic, any family becoming purchased that have a good Virtual assistant home loan have to be analyzed from the a beneficial Virtual assistant appraiser whom assures the house conforms toward minimal property standards: it needs to be structurally sound, safe, and you can hygienic. Should your possessions does not fulfill these criteria, the vendor must build repairs until the financing try signed. Including, in case the roof try leaking, the loan cannot romantic. In comparison, traditional funds do not require home inspections, definition a purchaser you certainly will purchase a home wanting fixes for a cheap price.

Va appraisals often take longer than just regular house valuations.At exactly the same time, when your appraisal really worth is lower compared to conversion rate, owner have to slow down the price towards the appraisal really worth, or perhaps the revenue cannot just do it. Getting a conventional loan, but not, the new activities is also renegotiate the cost and/or visitors will pay the essential difference between the fresh renegotiated rate plus the appraised worthy of. This provides the vendor much more liberty when your household does not appraise.

From all of these additional barriers, specific providers tends to be reluctant to sell to individuals who depend with the Virtual assistant resource. As the housing marketplace possess cooled off once the pandemic, of several home however rating multiple estimates. Whenever vendors provides solutions, they frequently end Virtual assistant funds. Beyond chronic misconceptions about the system, sellers frequently mention the house evaluation standards together with appraisal process while the reasons they’re reluctant to sell to Virtual assistant consumers.

Ultimately, loss mitigation getting upset Virtual assistant financing individuals is smaller sturdy than just getting individuals having GSE otherwise FHA loans, and this be sure 100 percent of your loan amount, weighed against an effective Virtual assistant loan’s 25 percent be sure. Whenever a borrower with a keen FHA otherwise GSE financing feel financial dilemmas, the fresh borrower is pause mortgage repayments for some time. Such skipped repayments is paid immediately or in the fresh new short-term, set in the end of the mortgage label, otherwise and an amendment propose to reduce the borrower’s repayments.

When you look at the pandemic, the Va given similar applications with the an urgent situation base, however these software efficiently finished within the 2022 (PDF). The fresh Virtual assistant will soon release an alternative losings minimization program, nevertheless choices it does allow for stressed individuals are nevertheless way more minimal than those provided by almost every other organizations. Broadening losings mitigation options for Virtual assistant individuals may help of numerous active-duty provider people and veterans end foreclosure and you will environment financial difficulties.

Latest system developments often get rid of traps, but so much more action is necessary

Since 2019, new Virtual assistant has taken strategies to reduce barriers produced by new appraisal techniques. If the a keen appraiser wants a beneficial valuation become below the brand new conversion process rate, the fresh appraiser is needed to alert new borrower and give this new real estate agent, lender, or debtor 48 hours available facts one to helps this new new conversion price. In the event the ensuing assessment remains underneath the conversion process rate, this new borrower otherwise bank can be demand a beneficial reconsideration of value out of the newest Virtual assistant. At the same time, during the , brand new Va questioned comments into the rulemaking transform who would finest make minimum possessions standards having business-wider possessions standards.

On , brand new Va tend to release new Pros Circumstances Maintenance Get (VASP) system, that’ll allow the service to get defaulted Virtual assistant funds whenever any kind of losses mitigation choices was sick. These types of VASP money can get a two.5 percent interest rate, end up being stored since the head financing from the VA’s profile, and become maintained of the VA’s special servicer. This means that, the applying enable troubled Va consumers for a mortgage modification that have a cost reduction. However, specific industry trade groups enjoys indicated issues about the required compliance deadline for mortgage servicers ().

Homeownership is important so you can building intergenerational wealth in the usa. To aid more energetic-obligations solution people and experts end up being and stay homeowners, policymakers should provide the fresh new Virtual assistant to your authority and you can resource called for in order to make loss mitigation software one to fulfill the GSE applications.