Any time you refinance your mortgage given that prices was shedding? Exactly what positives state

Over the last 24 months, sky-large financial costs make real estate loan refinancing reduced appealing getting home owners. Those who got low home loan prices inside pandemic saw zero need so you’re able to refinance. Meanwhile, people with higher cost commonly located closing costs carry out consume possible savings.

Although wave may be flipping – also it could affect their financial choices. If you are interest rates remain high compared to the historic averages, they’ve got recently decrease in order to good fifteen-day lower . For people who protected financing over the last eighteen months, you can ponder: “Is it time for you to re-finance? Should i save money because of the pretending today? Otherwise do i need to find out if rates shed subsequent?”

So you’re able to make an informed options, we talked with experienced home mortgage specialists. They mutual their views on the when you should re-finance, when to waiting and you will what factors you ought to consider.

Should you decide re-finance your own financial given that prices was falling?

The answer to you to question for you is: It all depends. Points just like your current financial situation, the interest rate you first secured and just how long you got the home loan see whether refinancing is the best disperse .

When refinancing can make feel

Refinancing is generally wise whether or not it causes high discounts more than go out. Josh Eco-friendly, loan maker at the Barrett Economic Group, means that a speeds get rid of away from 0.75% to a single% tend to justifies refinancing. So it prevention normally talks about the new settlement costs and you will relevant expenditures, allowing you to initiate spending less in the course of time.

Environmentally friendly points out the significance of taking a look at the breakeven point – the time it needs for the savings to help you provide more benefits than the newest refinancing costs.

“I think, you need to aim to lower your payment enough to coverage the individuals can cost you in this two years or quicker,” Green claims.

“Home values have raised, lowering the loan-to-really worth (LTV) for many borrowers, that may cause a far greater speed,” Hummel says.

Eg, whether your house’s worth increased regarding $three hundred,000 so you can $350,000 whilst you still owe $270,000, their LTV carry out lose out-of ninety% to over 77% – possibly being qualified you to possess a far greater rate.

Your credit rating may also feeling your choice. If it has actually improved since your totally new home loan, you might be eligible for a whole Egypt loans lot more good terms and conditions . Actually a tiny rise in your score you are going to convert to large offers more than the loan’s existence.

In the event it is far better re-finance later on

Even when the amounts are positive at first glance, refinancing isn’t always the best enough time-label method. Hummel offers an example you to definitely portrays so it difficulty: “Should you have an effective $step 1,000,000 mortgage at seven.50% and you can today’s rate are seven.00%, with settlement costs out-of $4,five-hundred to own an effective ‘No Point’ refinance, you would conserve $338 monthly. The newest breakeven section might be seven weeks.”

Although this scenario suits the average standards to have a beneficial refinance, “could result in expenses numerous costs to your several refinances in the event the pricing still fall,” Hummel claims. So it shows an option thought: Refinancing too often can be deteriorate possible savings because of constant closing costs.

“The many benefits of refinancing are influenced by the loan dimensions since of a lot costs to help you re-finance was fixed,” states Dean Rathbun, loan officer during the Joined American Financial Firm.

Getting mortgages less than $250,000, the product quality step one% rate reduction will will not create adequate deals so you’re able to validate the expense. In these cases, waiting around for a bigger rate get rid of or exploring most other financial tips could well be far more sensible than racing towards home financing refi.

A few in advance of refinancing

- Amount of stand: Just how long you want to remain in your home affects the prospective discounts out of refinancing.

- Financing title: Shortening the home loan identity will save you into the notice, while you are stretching this may down payments but boost the full attention paid.

- Coming lifestyle change: Think after that situations like old-age that will impression your future income and you may being qualified feature.

- Sector time: Weigh the dangers out-of awaiting possibly lower pricing facing most recent deals potential.

The conclusion

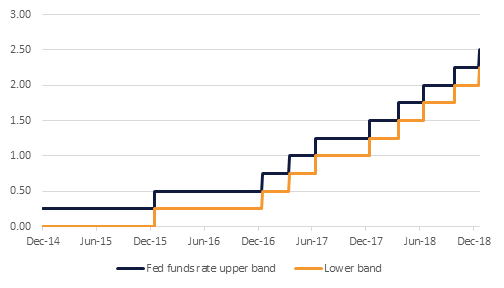

Regardless of if nobody enjoys an amazingly baseball having a mortgage appeal speed forecast, Green thinks the audience is in early stages from a rate-dropping course. “If your Federal Set aside knowledge which have a speed slashed, mortgage interest rates you’ll consistently drop for another several weeks or even stretched,” he says. However, wishing boasts dangers. For those who discovered at level prices and then have a sizable financing, refinancing now you certainly will initiate helping you save currency. Holding out could trigger top costs later – but upcoming field criteria is actually unsure.

Your very best financial move ? Keep in touch with multiple loan providers. Know and discuss your options, score personalized rates prices and become ready to operate quickly when the latest standards was right. An appropriate time for you to re-finance happens when it’s a good idea getting your unique problem – perhaps not whenever cost strike a particular number.