Facts to consider Before applying to have a Santander Do it yourself Mortgage

initially Uk Mortgage loans claims one Santander do it yourself finance succeed borrowers to fit the mortgage name on the home loan. This is why consumers is also manage their financial and you may do-it-yourself financing costs to each other, making it simpler to help you finances their cash.

Eligibility Criteria

Qualifications criteria to possess an excellent Santander do it yourself loan become becoming 18 age otherwise earlier, having a credit history, and having adequate earnings to make normal repayments. It is vital to always see such criteria before you apply having a great Santander home improvement financing.

Before applying to have good Santander do-it-yourself loan, there are many things that you should consider so as that this is the best financial product for your requirements.

Your credit rating

Your credit score is an important component that establishes your qualification to have a good Santander do-it-yourself loan. When you yourself have good credit, youre likely to discovered a reduced interest rate into the the loan. It is very important look at the credit history before you apply getting a beneficial loan to make certain that it is within the good updates.

Your debts

It is important to think about your financial situation before you apply having a beneficial Santander do-it-yourself loan. You should make sure to have sufficient money to make normal loan repayments next to your own mortgage repayments. If you find yourself unsure regarding the financial situation, it is better to speak with a monetary coach in advance of making an application for that loan.

Extent You should Borrow

Before you apply to have an effective Santander do-it-yourself loan, you should consider the total amount you will want to acquire for the renovation endeavor. You really need to be sure to only borrow the amount that you need certainly to end investing more attract costs.

Cost Months

It is critical to take into account the repayment several months for the Santander family update mortgage. You will want to make sure to can also be carry out the loan repayments near to your own mortgage payments. When you are not knowing regarding the fees months, it is advisable to speak with a monetary mentor in advance of obtaining that loan.

Financing Small print

Before applying having a good Santander do-it-yourself financing, it is very important read the financing small print cautiously. You should make no credit check payday loans Greenville AL sure to see the interest rate, installment months, and you can any extra charge which can implement. When you are unsure from the some of the loan conditions and terms, it is preferable to speak with a financial coach ahead of obtaining that loan.

Almost every other Financial support Options

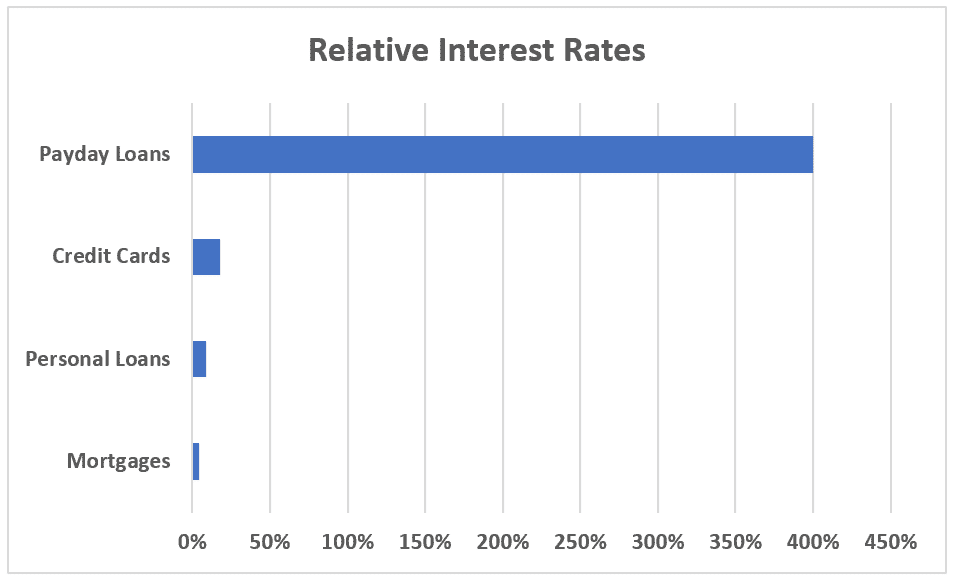

Santander do-it-yourself funds aren’t the only funding option readily available to suit your renovation venture. You must know other financing solutions such as for instance personal loans, playing cards, or remortgageing your property. It is very important browse most of the investment available options to help you your before deciding.

Simple tips to Submit an application for a Santander Do it yourself Financing

Obtaining a Santander do-it-yourself mortgage is an easy process. Is one step-by-step guide on how best to make an application for an excellent Santander do it yourself mortgage.

Step 1: Look at your Qualifications

Before you apply to own a great Santander do it yourself loan, you need to ensure that you meet up with the eligibility standards. This type of standards were being 18 decades otherwise more mature, with good credit rating, and having sufficient earnings and also make normal payments.

2: Assess the borrowed funds Amount

Before applying to have good Santander do it yourself financing, you should determine the loan number you desire to suit your renovation project. You can do this of the quoting the price of the recovery investment and subtracting any deals you may have.

3: Gather Needed Data

To apply for a Santander do it yourself mortgage, attempt to provide several records eg proof of earnings, proof of identity, and you will proof of address. It’s important to gather these files before you apply for a financial loan.