Do Rocket Mortgage Work with My personal Town?

Rocket Home loan revealed from inside the 2015 because deal with of Quicken Loans’ on the internet financial app. It is now largely provided having Quicken, and obtaining the exact same underwriting requirements. Inside 2021, Quicken Financing is actually rebranded due to the fact Rocket Mortgage. Part of the mark out-of Rocket Home loan is the fact that the entire financial process can happen on the internet. Customers is also finish the software in place of talking with just one service user. Although not, the choice to speak so you can a representative exists.

Based during the Detroit, Rocket Mortgage is the premier on the internet home loan company, according to National Home loan News. Built for the 1985, the organization has grown to help you originating 464,000 money for the 2022 alone.

Skyrocket Financial are ended up selling once the an on-line-merely service, towards the choice to name otherwise cam on the internet if you choose. What kits Rocket Financial apart from the race is actually YOURgage, an element which enables you to find your home loan term to have a predetermined-speed mortgage. This type of device allows you to favor a term out of 8 in order to 29 decades, whatever works best for you. When you make an application for a loan, you can view just how your instalments perform changes for folks who to alter term, speed otherwise settlement costs.

What sort of Financial Do i need to Get Having Skyrocket Financial?

You could potentially generally submit an application for all the same financing supplied by Rocket Mortgage’s on line app program. For this https://paydayloanalabama.com/lockhart/ reason, you have enough possibilities whether you’re searching for a normal loan, or something like that much more specialized for the problem. The loan selection are:

Fixed-rates mortgage: This preferred financial particular hair on your own rate of interest into the expereince of living of the financing. It means your own month-to-month prominent and you may appeal percentage stays the same, which of several look for utilized for budgeting and think. There clearly was the quality fifteen-year and you can 31-seasons repaired-price financial choice. This is as well as the sort of loan YOURgage uses, however with variable terminology.

Adjustable-price mortgage: Such mortgage, the new Sleeve, does what title indicates: changes the rate. Once you reach the prevent of your 1st fixed-rate identity, your desire is certainly going right up otherwise down (labeled as changing) after a-year. Discover five-season otherwise seven-season Possession at the Skyrocket.

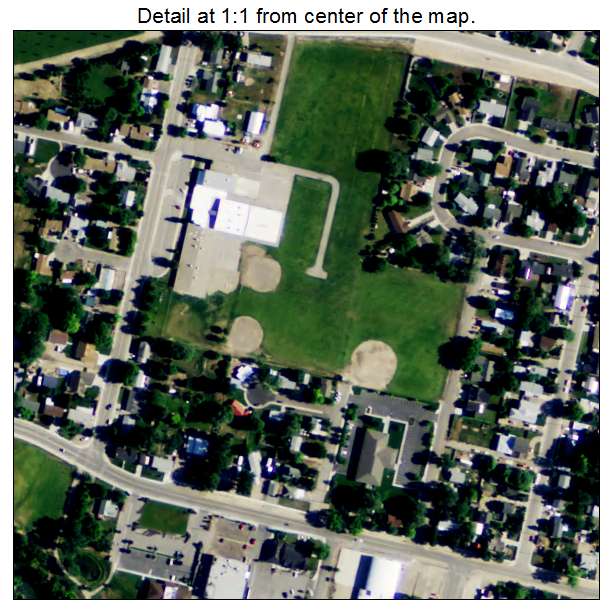

Nations Prepared by Skyrocket Mortgage

Government Construction Government (FHA) loan: An FHA financing helps individuals with limited down payment fund and you will lower credit ratings qualify for a mortgage. Rocket Mortgage states you to fico scores as low as 580 could possibly get be eligible for financing, but it hinges on your position. The options tend to be 31-, 25-, 20- and you can fifteen-12 months repaired-rate terms and conditions as well as four-season Arms. For those who be considered, you can get a home which have as low as 3.5% off.

Experienced Products (VA) loans: This new Va backs such finance getting certified experts and you will effective responsibility solution users. Skyrocket Mortgage also offers 31-, 20- and you can 15-seasons repaired-rates fund and additionally five-seasons Sleeve Va financing. A few of the benefits of this type of financing were zero deposit otherwise monthly personal home loan insurance.

Jumbo mortgage: You might have to speak with a real estate agent within Rocket Financial to see if your be eligible for this type of financing. Jumbo money are to possess mortgages one meet or exceed the brand new conforming loan maximum in the area you want to buy inside the. You will need at the least a good 680 credit rating to help you be considered, plus a great financial obligation-to-earnings ratio. Fund become given that higher during the $dos.5 billion to have certified consumers.

YOURgage: You might customize their mortgage which have Rocket Home loan. You decide on the fixed-rates mortgage traditional mortgage label, between 7 and you can 30 years, for your financial predicament. You may also shell out as little off during the step three%. Which have YOURgage, you additionally have the possibility in order to re-finance up to 97% in your home well worth.