USAA Pros: Know how to Benefit from an Assumable Mortgage

The modern economic surroundings merchandise a challenging situation to possess USAA retirees and very quickly is retirees, particularly in light of your own almost doubled financial prices than the 2021. This move features led to enhanced house-financial support costs, after that tricky from the residents unwilling to relinquish the lower mortgage cost, leading to a chronic lack during the property directory and you will staying home costs increased.

A notable strategy emerging in this perspective is the idea of assumable mortgages. Speaking of agreements in which a purchaser takes over the seller’s existing loan, inheriting the rate of interest and you may payment words. Study out of Redfin indicates that to 85% regarding characteristics in the business has actually funds with interest rates less than 5%, a fact one to underscores the potential financial benefits associated with this approach to have people. For residents, it includes a sleek path to sell their features.

Understanding how assumable mortgage loans job is crucial for USAA benefits. Within configurations, the customer assumes the fresh seller’s financial, together with its rate of interest, leftover fee plan, and you may mortgage harmony. This is certainly such useful whenever rates are on the rise, allowing people in order to protect a diminished speed than might be available using a new home loan. The consumer, not, need certainly to meet the lender’s certification criteria, similar to trying to get a basic home loan. Including tests of credit rating, debt-to-earnings ratio, and other monetary issues. A serious advantage is that family appraisals are generally not needed, probably hastening the applying techniques and you may cutting associated charges.

Despite its desire, assumable mortgages commonly versus constraints. Mostly, most mortgages are not assumable, with this specific alternative usually limited to authorities-backed fund such as FHA, Virtual assistant, and you may USDA finance. According to the Financial have a glimpse at this link Lenders Association’s Each week Programs Survey, this type of loans constituted only 18% so you’re able to twenty six% of residential loan applications for the past 3 years.

Checked Movies

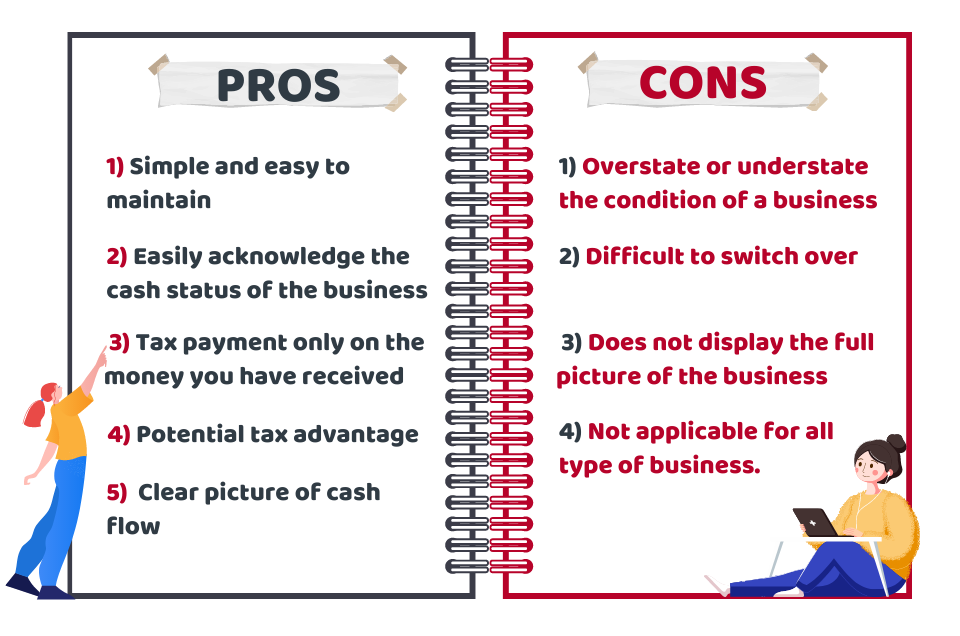

The benefits to possess consumers is potentially lower home loan cost and you may smaller upfront costs, if you are vendors that have advantageous mortgage conditions you can expect to get more buyers. not, you’ll find downsides, like the probability of requiring a moment home loan and a beneficial large advance payment. This stems from the fact that an assumable loan scarcely talks about the whole purchase price of the home, requiring extra money otherwise away-of-pouch expenses so you’re able to connection the latest pit.

The newest complexity off merging assumable fund, second mortgage loans, and off repayments to match brand new residence’s price requires careful said. Additional challenges range from the higher interest levels and closing costs relevant having 2nd mortgage loans, and more strict qualification requirements as a result of the increased chance so you’re able to lenders.

Within the navigating this type of alternatives, looking around and you may comparing also provides of numerous loan providers is key. This is true for both assumable money and you may second mortgage loans, plus new house money. Balancing home loan cost up against costs is vital to finding the right complement one’s financial specifications and you will funds. Rather, never assume all lenders bring next mortgage loans, that could require comprehensive looking.

For individuals nearing old age out of USAA, like people with large equity within house, an assumable mortgage also provides an avenue to help you potentially help the people otherwise grandchildren during the homeownership. A study by National Association from Realtors (typed in the ) suggests that intergenerational transfers out of assets are getting more widespread because the a means of enabling younger family unit members enter the housing marketplace. This kind of problems, incase the loan away from a household home can be an economically smart method, providing more youthful years to benefit of lower rates of interest while keeping family relations possessions continuity. This method should be eg glamorous in the a weather from rising financial costs and housing marketplace uncertainty.

Stuff you could find interesting:

- 0″>

To conclude, whenever you are government-backed financing including Va otherwise FHA money are generally assumable, the procedure relates to factors such as for instance securing the next home loan and managing large off costs. These a lot more will cost you may well not make with every homebuyer’s funds, particularly for very first-date customers just who you will rely on lowest- if any-down-fee fund. Hence, knowing the the inner workings of those economic devices is important for making informed decisions in the current market.

Navigating the current housing market with assumable mortgages try comparable to a seasoned sailor using advantageous winds in the a difficult water. Just as a skilled sailor spends knowledge and experience to leverage breeze assistance to have an useful voyage, educated home owners and very quickly-to-getting USAA retirees are able to use assumable mortgages to take advantage of current lower interest rates from inside the a market where cost has almost doubled. This process, much like finding a steady piece of cake, can lead to a smoother and costs-active journey inside the investment, missing the fresh new harsher waters out-of large-rates of interest and you may limited houses directory, much as a great sailor prevents turbulent waters to have a far better and you can pleasant voyage.