Ohio FHA Funds: An excellent Opportunity for Homebuyers

Could you be likely to buy property from inside the Kansas however, stressed toward down payment? FHA financing might help eliminate the dependence on an enormous down payment.

With only a good 3.5% down payment, Ohio FHA financing render a beneficial opportunity for homebuyers to meet up its think of owning a home. On this page, we will talk about the great things about Ohio FHA finance, and the you can easily downpayment advice applications readily available for Kansas homebuyers.

Benefits of Kansas FHA Financing:

One of many significant great things about Kansas FHA financing is that they offer low-down commission selection. With only good 3.5% deposit, homeowners can purchase a home https://paydayloanalabama.com/white-hall/, no matter if they do not have a pile of cash reserves. This can be particularly great for of many very first-day buyers into the region places such as for example Cleveland, Columbus, Cincinnati, Toledo, and you will Akron whilst has got the possibility to end up being a resident without any weight of a massive deposit.

At the same time, FHA fund has all the way down credit history requirements, making it simpler to own customers in order to be eligible for a loan. Along with, FHA loans provide aggressive low interest rates, meaning that homebuyers can help to save a lot of currency throughout the years. Please discover more about all the FHA Loan Facts here.

According to 2024 FHA home loan limitations, the most loan amount to possess an individual-family home for many counties inside Ohio is $498,257. This really is for one step one-product possessions, multiunit attributes including dos-4 plex is higher still.

A small number of areas inside main Ohio & Columbus MSA such Franklin, Fairfield, Delaware, Hocking, Licking, Madison, Morrow County, Pickaway, Perry, and you will Partnership State have even highest restrictions away from $546,250.

Multiple downpayment advice software are available for Kansas homebuyers. Brand new Kansas Housing Financing Company (OHFA) offers multiple software, for instance the Homebuyer Recommendations System, the latest Offers to own Grads System, as well as the Ohio Heroes Program. This type of applications are designed to let first-time homeowners, pros, or any other qualified homeowners into the down-payment and you can closing costs.

*Please be aware, the capital and you may availability of such deposit recommendations programs can change all year round. Delight apply to you right now to find out about the modern options available.

FHA and permits the house merchant to invest the latest client’s closing costs. Closing costs and you will pre-paids escrows to have such things as taxation and you will homeowners insurance supplies can be add up to 2-5% of your own price. That is as well as the lowest step three.5% downpayment. Making it best that you be aware of the customer is also discovered concessions out-of the house vendor because of it prices.

Ohio FHA fund provide a opportunity for homebuyers, especially those that are enduring the advance payment tend to expected of the traditional fund. In just a step three.5% down payment, homeowners should buy property, regardless of if they do not have a pile of cash reserves.

Additionally, FHA fund have lower credit rating criteria and provide competitive focus costs, making it easier to possess buyers in order to be eligible for that loan and spend less over time. If you are planning to shop for a house inside Kansas, make sure you mention the latest offered down-payment direction programs.

FHA Streamline & Cash-Away Refinance:

As the rates begin to fall off, the brand new refinance options are to get popular once more. FHA also offers a streamline refi choice to Ohio residents shopping for an easy interest reduction. Additionally, residents having equity can mention dollars-out re-finance choices up to 80%-85% mortgage so you’re able to worth. The bucks-aside re-finance system can be helpful getting consumers looking to consolidate personal debt, or money expected home improvements, etc.

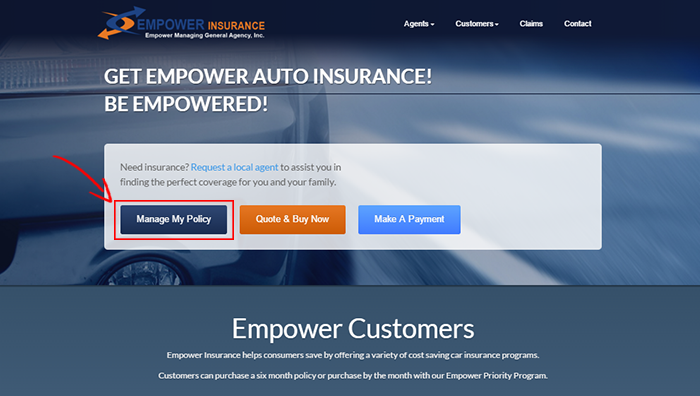

Excite apply to us seven days per week to learn more or initiate your application. Excite name the quantity a lot more than, or simply just complete the details Request Function in this post.