Improving your credit rating, repaying debt, and you will boosting your income may also help for the enhancing your refinancing applicants

At exactly the same time, if for example the market value of your house features diminished or if perhaps your debt regarding the mortgage compared to the economy worthy of, you really have negative equity. This will allow more difficult so you can refinance their home loan just like the loan providers could be reluctant to promote a loan you to is higher than new property’s value.

Conquering Refinancing Difficulties

In such instances, you may have to explore option possibilities, for example loan mod or negotiating along with your loan providers to get an answer that actually works for both parties.

The current market value and you will equity status of your house gamble a life threatening part on the capability to re-finance an enthusiastic financial. Self-confident security and you can a favorable market value can cause better refinancing alternatives, if you are negative security otherwise a reduced market price might require investigating choice solutions. It is vital to daily screen the home’s worth and equity reputation and make informed choices throughout the refinancing.

Popular Demands When Desire Refinancing mortgage

Navigating the brand new state-of-the-art field of refinancing a mortgage would be a daunting task, particularly when discussing an enthusiastic financial. These types of mortgage, having its an initial financial having 80% of your own residence’s worth an additional financial to your leftover 20%, gift suggestions its own selection of challenges and you can barriers getting borrowers. Let us talk about a number of the popular difficulties borrowers can get come upon whenever attempting to re-finance a keen mortgage and exactly how they may be able decrease brand new danger .

step 1. Equity Requirements

The original problem borrowers can get face was appointment the fresh new collateral requirements getting refinancing an enthusiastic home loan. Very loan providers wanted borrowers for some security in their home in advance of they can refinance. This can be burdensome for anyone who has viewed a fall in their home’s worthy of otherwise haven’t made good-sized payments on the the main equilibrium. In such cases, consumers might need to explore choice possibilities otherwise wait until it possess gathered sufficient guarantee to fulfill the lender’s criteria.

Mitigation

So you can mitigate this chance, borrowers is work at raising the worth of their houses owing to renovations or expanding the monthly mortgage payments to create guarantee quicker. It is best to search the new pointers from a mortgage elite who’ll provide good advice towards top action to take.

dos. Credit rating Considerations

A new obstacle borrowers may face when refinancing a keen mortgage is the effect on its credit score. Loan providers generally speaking consider credit ratings included in the refinancing process and might wanted consumers getting a specific credit history so you can qualify for a separate mortgage. If the a beneficial borrower’s credit score possess reduced as the obtaining totally new financial, it could be challenging to secure favorable refinancing words.

Mitigation

To decrease this risk, consumers will be manage boosting their credit rating before applying having refinancing. You can do this by paying costs timely, reducing personal debt, and you will resolving one problems with the credit history. Consumers can be talk online loans in Oak Hill about a choice of a co-signer with a robust credit history to boost their chances of approval.

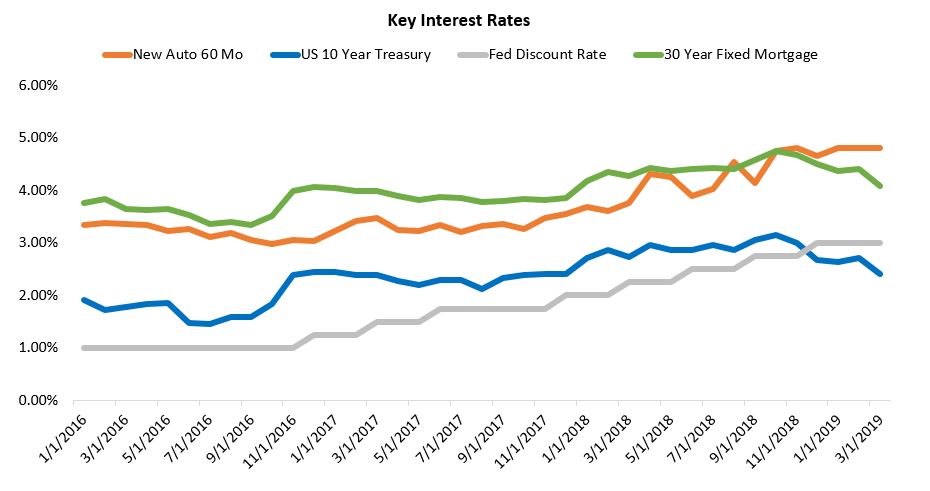

step 3. Highest Rates of interest

You to possible disadvantage off refinancing a keen mortgage is the odds of large interest rates. As the second financial inside the an enthusiastic mortgage is regarded as a beneficial riskier mortgage having lenders, they may fees higher rates to pay to your improved risk. This may lead to large month-to-month home loan repayments and you can potentially negate the great benefits of refinancing.

Mitigation

So you can mitigate it exposure, individuals can be comparison shop and you may contrast also offers regarding additional lenders so you can find a very good rates and you will words. It is reasonably advisable to run a professional large financial company who can negotiate towards borrower’s part which help secure far more good prices.