Does financial pre acceptance apply to credit score

When it comes time to find another type of domestic, pre-approval is a fantastic solution. This process makes you find out how much a great financial is willing to provide you while the a debtor. And that form you will end up in the an excellent standing locate a home that works well within your budget and you may matches all dream requirements.

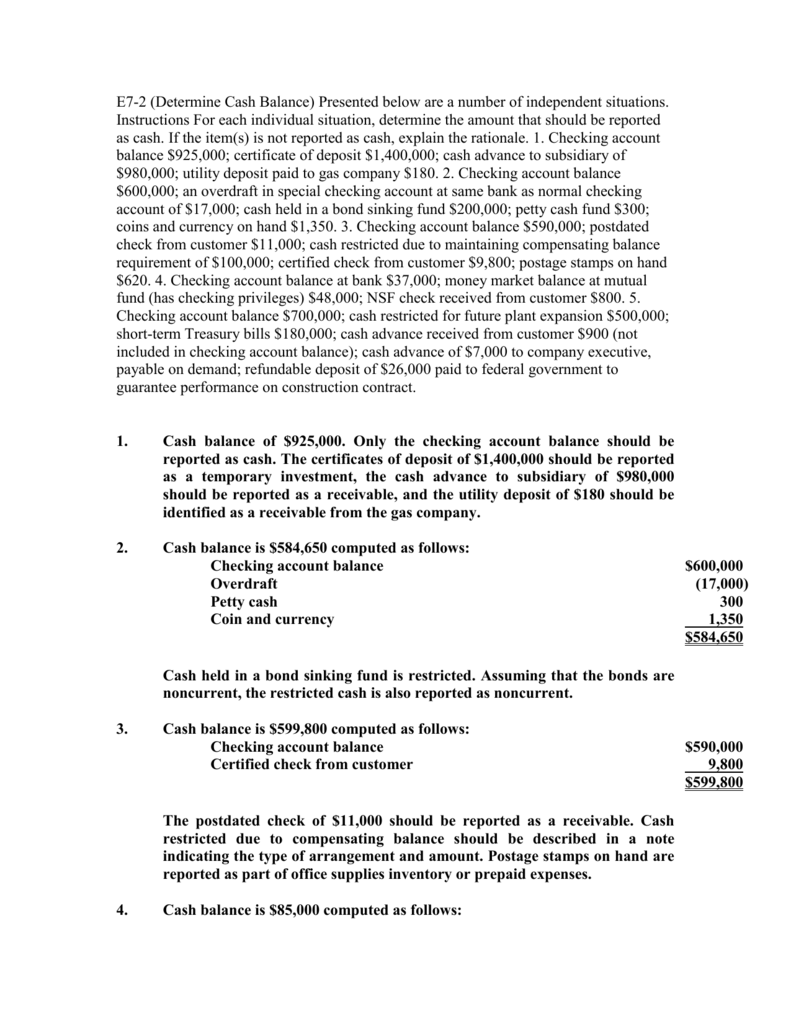

However, really does delivering pre-acceptance having home financing connect with your credit rating? And if so, will they be really worth searching for?

What exactly is pre-recognition?

If you are looking to buy a different sort of house, a great pre-acceptance is a vital part of the process. Also called good conditional approval’, home financing pre-acceptance form the lending company enjoys concurred theoretically to help you lend your currency on acquisition of your property. And it is this that delivers the environmentally friendly white to really begin negotiating and purchasing the place to find their desires.

Benefits of pre-acceptance

- Confirming your own buying fuel. Pre-acceptance teaches you precisely the number that one can be able to spend on your brand new home.

- Outsmarting the competition. Their pre-acceptance lets you circulate punctual during the a competitive market.

- Reduced closure. A home loan places you in a position to intimate quickly on any potential product sales, that renders your more desirable so you’re able to sellers.

- Saves you time and money. After you know your financial allowance you could potentially laser beam desire your hunt, rescuing time and money.

- Handles your own put. You generally you prefer in initial deposit to order a home. But if you are unable to obtain the remainder of the resource, your own deposit will be on the line. Pre-approval handles you against this risk.

Getting pre-recognition having a mortgage can impact your own borrowing from the bank… but it has no to. Get in touch with the experts, who happen to be here to greatly help.

Risks of pre-acceptance

But do providing pre-recognition to possess a mortgage affect borrowing from the bank? Sure, this is certainly a danger once you make an application for multiple pre-approvals.

To your harmony, we come across the great benefits of pre-approvals so you can much provide more benefits than the dangers. However, providing several pre-approvals isn’t the approach to take. Both people accept that it can provide them with an advantage for the obtaining household of its ambitions. However, indeed, this may make you inside a great worse position.

Each time you submit an application for a beneficial pre-approval, the financial institution often look at the document and you may credit rating. This enables them to use her exposure examination for your requirements since a buyer. Such enquiries facing the credit are called tough enquiries’ and bad credit payday loans Livingston AL tend to be a form of credit assessment. This means that each time you apply for a good pre-approval its registered on the credit history.

Multiple difficult enquiries, particularly if he could be done within same go out, often means so you can financial institutions your when you look at the financial hardships. They pick such numerous enquires and you will believe that you have been declined from the these lenders. This may following decrease your credit rating, causing you to research riskier than you really was.

Hard enquiries can stay on your credit score for five years. Thus, you really want to be sure to are merely searching for brand new pre-approval that you have to have.

Delivering a great pre-approval that will not harm your credit score

Providing pre-recognition to own home financing make a difference to your borrowing from the bank… nonetheless it does not have any so you’re able to. The initial step would be to always would numerous research consequently they are searching for suitable loan types of and you may bank to have your position. This can help you to stop the challenge out of chasing pre-approvals out-of several lenders.

If you have already taken out pre-acceptance, but the time period enjoys go out (fundamentally 3 months), check with your bank. Ask them to stretch your own pre-recognition, in lieu of going through the pre-acceptance techniques once again.

In the long run, keep on top of your credit score. Opinion it yearly to be certain there aren’t any mistakes one you might rectify before you apply to own home financing pre-approval.